by Jon Bednar

Planning for retirement is exciting and covers many parts of your life. One of the most important aspects is ensuring your financial future is well planned. A secure financial retirement plan can help you rest easy about the future and can allow you to have a retirement to look forward to.

Tellico Village resident and financial advisor Jon Bednar has put together some tips to get you thinking about the financial side of retirement.

If you have already retired or if you can count the number of years until retirement on your fingers, then please heed this friendly warning: Unless you’re already making the most of your current retirement planning strategies, then it may be difficult to lay the groundwork for a financially secure future.

Is your portfolio on a course that’s destined to lead to a retirement income shortfall? Consider these strategies that can help improve your long-term outlook.

During Your Working Years

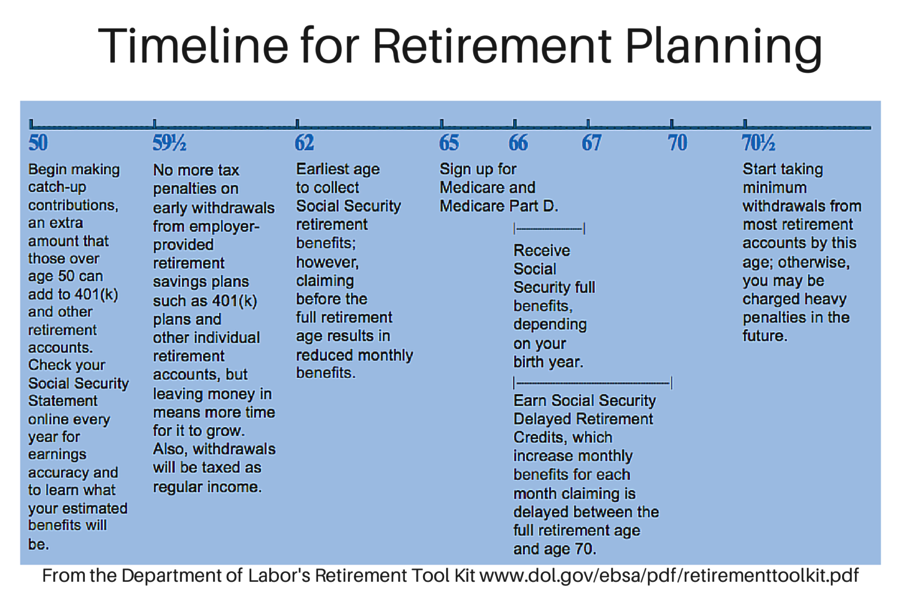

Determine an appropriate time frame for applying for Social Security benefits. If you plan to apply before your so-called “full retirement age,” then you can expect to receive lower monthly benefits. Delaying your application could increase your benefits. Detailed information about your specific situation is available online from the Social Security Estimator. Contact Social Security at least three months before retirement to apply for benefits.

When You Reach Retirement Age

Make arrangements for your retirement account distribution strategies. If you participate in a workplace retirement plan, contact your employer’s human resources office to learn which withdrawal options are available to you. Once you have that information handy, you’ll need to decide whether to begin withdrawing money from your taxable accounts or from tax-deferred accounts first.

Keep in mind that the IRS requires most retirement savers to begin taking withdrawals, known as required minimum distributions (RMDs), from your employer-sponsored retirement accounts and traditional IRAs after reaching age 70-1/2. If you don’t take your RMDs, you could be forced to pay substantial tax penalties. RMD rules recently became less complex, but it’s still important that you understand them and implement an appropriate distribution strategy.

All Retirement Investors

Review your postretirement medical insurance needs. For example, you might want to think about purchasing coverage to supplement Medicare benefits.

Your retirement security is very important. A smart first step to keeping your retirement strategies on track is to contact a qualified financial professional.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.